- Download PDF of the report

- Executive Summary

- Introduction

- Chapter 1 – Importance of Freight to Minnesota

- Chapter 2 – Current and Future Freight Trends and Issues

- Chapter 3 – Minnesota’s Freight System Assets, Conditions and Performance

- Chapter 4 – Freight Forecasts

- Chapter 5 – Freight Policies and Strategies

- Chapter 6 – Sustainable Truck Trends and Strategies

- Chapter 7 – Freight Investment Plan and Implementation

- Appendix A – Critical Urban and Rural Freight Corridors

- Appendix B – Freight Performance Measures

- Appendix C – IIJA State Freight Plan Requirements

Sustainable Truck Trends and Strategies

This chapter provides a summary of the trends related to the reduction of environmental impacts by medium and heavy duty (MHD) vehicles, specifically related to the reduction of greenhouse gas emissions. This includes an overview of MHD vehicle activity and emissions in Minnesota, an overview of the many available vehicle emission reduction strategies and a summary of considerations that should be taken into account when considering the different strategies. This paper also includes a review of recent Regional and national regulations, plans and studies relevant to MHD vehicle emissions reduction. Finally, the paper concludes with a listing of proposed goals and strategies for MnDOT to consider as part of the broader State Freight Plan development process.

Overview

Greenhouse gases (GHG) are gases that absorb and emit infrared radiation emitted by the earth. They include CO2, Methane, Nitrous Oxide and Flurorinated gases. Their increased presence in the atmosphere is a leading contributor to global warming and climate change. In 2021, the transportation sector accounted for an estimated 28% of total U.S. greenhouse gas emissions. In response to this growing issue the U.S. Department of Transportation (U.S. DOT) has set multiple climate and sustainability goals, including a substantial reduction in greenhouse gas emissions and transportation-related pollution. The bipartisan 2007 Next Generation Energy Act set statutory benchmarks to reduce GHG emissions 15% from 2005 levels by 2015, 30% by 2025 and 80% by 2050. The U.S. DOT FY 2022-2026 Strategic Plan includes goals to achieve net-zero emissions from all operations by 2050.

Minnesota has also set statewide goals to reduce collective greenhouse gas (GHG) emissions. In 2022, Minnesota’s Climate Action Framework updated goals to reduce emissions 50% by 2030 and achieve net-zero emissions by 2050. Minnesota’s overall GHG emissions decreased 23% between 2005 and 2020.

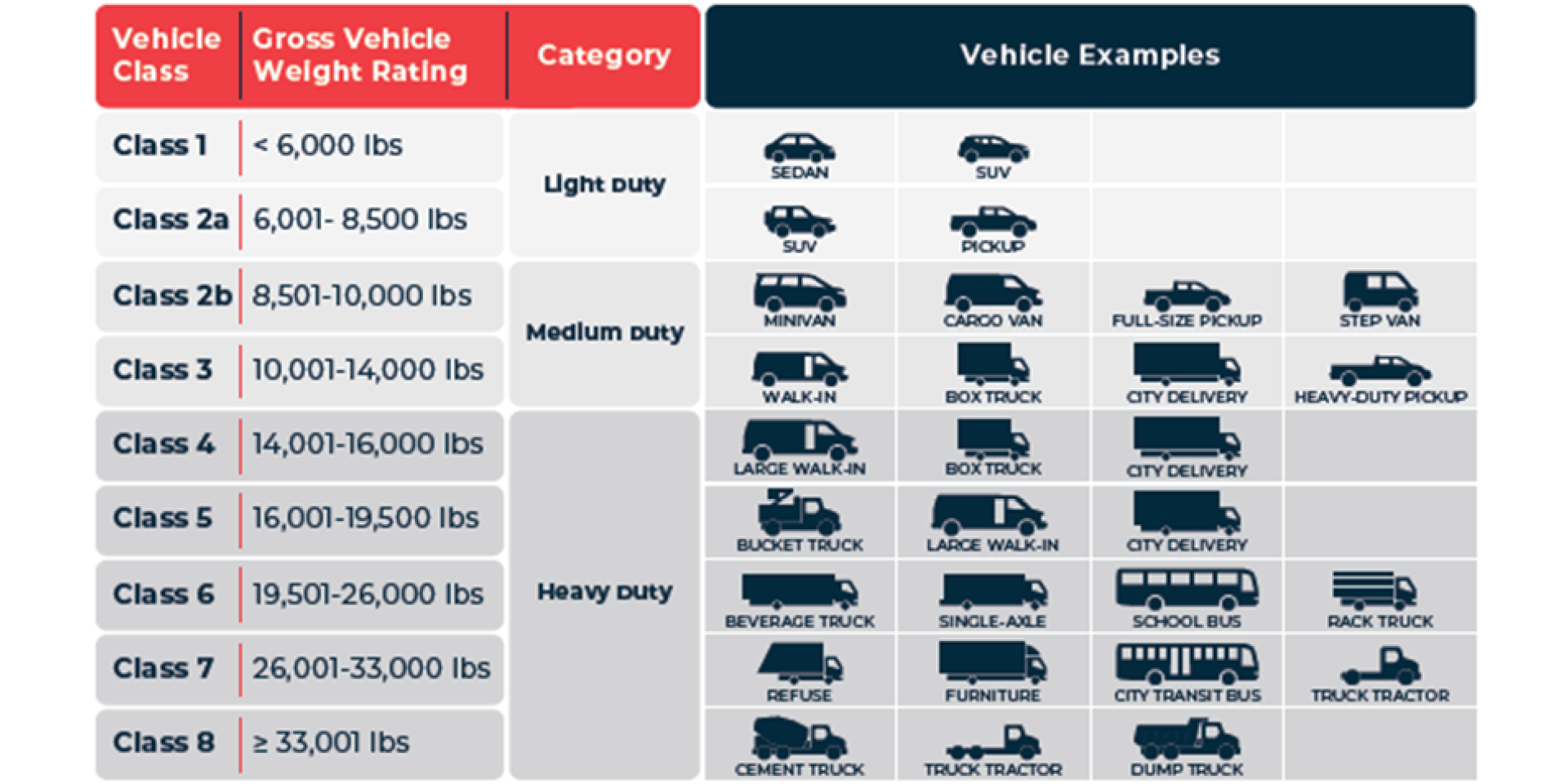

Medium and heavy-duty (MHD) vehicles are the second largest source of GHG emissions in the transportation sector, despite these vehicles making up a relatively small proportion of the overall vehicle population. Vehicles are classified according to their gross vehicle weight rating (GVWR), with different weight ratings grouped into vehicle classes and categories as shown in Figure 1. MHD vehicles are those vehicles with a gross vehicle weight greater than 8,500 pounds.

MHD vehicles are vital to the Minnesota economy. As the above figure illustrates, there are many different users of MHD vehicles. Farmers and contractors using heavier model pick-ups; school buses and transit bus operators employing a variety of models to transport people to work, school and leisure activities; delivery companies using vans and small trucks to deliver packages; food and beverage companies employing straight trucks and tractor trailers delivering goods to stores; farmers, fuel distributors and mineral companies using trucks to move bulk products from production sites to onward distribution facilities; and, Class 8 tractor- trailers operating long distance routes to bring products and consumables to the state. These uses all differ in terms of the type of vehicle they use, the distance traveled, routes taken, where vehicles are based, vehicle ownership models and crucially for many MHD vehicle operators, the financial and business metrics that drive their operations.

Figure 6-1: FHWA Vehicle Classifications

MHD Vehicle Emissions In Minnesota

Transportation remains the largest source of GHG emission in Minnesota accounting for approximately 25% of the state’s total GHG emissions. However, since 2005, these emissions have been trending downward with an 18% reduction in GHG emissions between 2005 and 2020. This compares to a reduction of 54% for electricity generation and increases of 14% each for residential and industrial sources over this same time period.

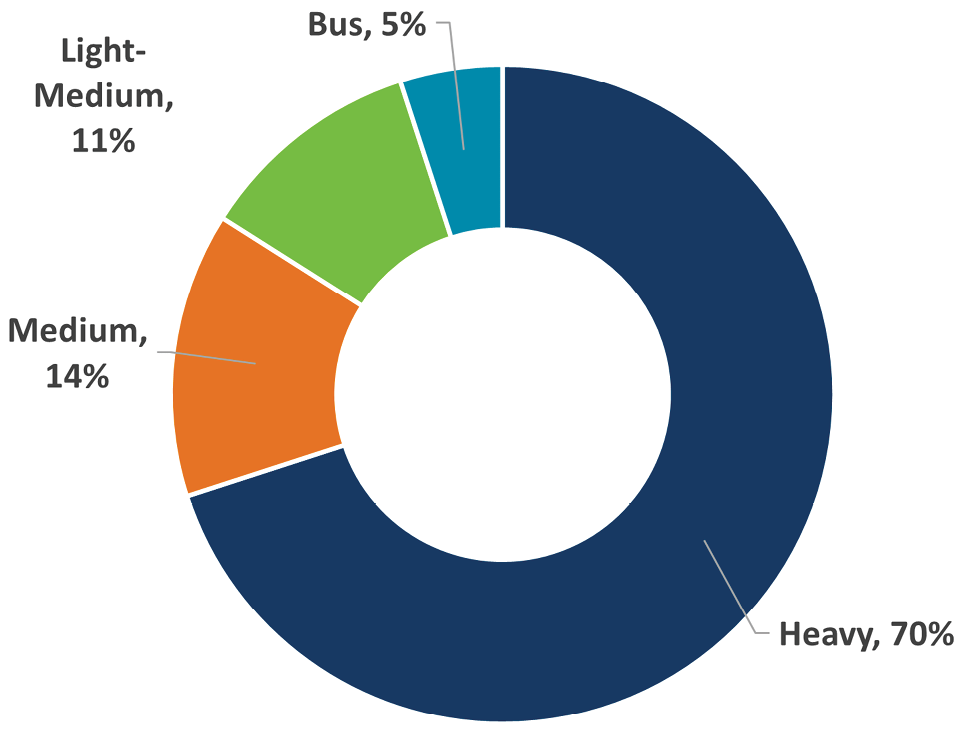

In terms of the national emissions inventory, transportation accounts 35% of total U.S. CO₂ emissions. Within the transportation sector, passenger vehicles, light-duty trucks (including SUVs) and medium to heavy-duty trucks produce more than 70% of emissions. Light-duty trucks accounted for 13.2 million tons of emissions in Minnesota (CO₂ equivalent) and heavy-duty trucks 6.9 million CO₂ e-Tons in 2020. Heavy-duty vehicles are the largest source of mobile NOx and the second largest source of GHG emissions in the transportation sector. According to EPA, heavy-duty vehicles would contribute 32% of the mobile source NOx emissions and 89% of on-road NOx emissions, in calendar year 2045. GHG emissions from transportation have decreased by about 18% since 2005. Key factors include reduced travel during the COVID-19 pandemic and more stringent emissions standards associated with federal regulations reducing vehicle emissions. The proportion of national MHD vehicle emissions categorized by vehicle use and length of journey is illustrated in Figure 6-2.

Figure 6-2: Transportation Sources of GHG Emissions

Source: NREL report Decarbonizing Medium- & Heavy- Duty On-Road Vehicles: Zero-Emission Vehicles Cost Analysis (nrel.gov)

Connections to Regional and National Regulations, Plans and Studies

Multiple plans exist at both the regional national level that have established standards, guidance and recommendations for the adoption of emissions reduction strategies.

Minnesota Next Generation Energy Act

The Next Generation Energy Act establishes a statewide goal “to reduce statewide greenhouse gas emissions across all sectors producing those emissions to a level at least 15% below 2005 levels by 2015, to a level at least 30% below 2005 levels by 2025 and to a level at least 80% below 2005 levels by 2050.”

Clean Cars Minnesota Rule

In 2021, the MPCA adopted the Clean Car Minnesota rule that requires automobile manufacturers to deliver for sale in Minnesota only passenger cars, light-duty trucks, medium-duty vehicles and medium-duty passenger vehicles that are certified by California as meeting the low-emission vehicle (LEV) standard.

The low-emission vehicle standard sets tailpipe pollution limits and requires manufacturers to produce new light and medium-duty vehicles with lower emissions.

Statewide Multimodal Transportation Plan

As the highest policy plan for transportation in Minnesota, the Statewide Multimodal Transportation Plan (SMTP) provides objectives, performance measures, strategies and actions to move Minnesota’s transportation system forward. These collectively make up the policy direction that answers, “How are we going to achieve a multimodal transportation system that maximizes the health of people, the environment and our economy?”

The SMTP established a target to reduce annual GHG emissions from the transportation sector by 80% from 2005 levels by 2040, along with interim targets.

Minnesota Carbon Reduction Strategy

In February 2024, MnDOT received approval of the Minnesota’s Carbon Reduction Strategy (CRS) from the Federal Highway Administration. The strategy informs how federal Carbon Reduction Program funds will be spent and identifies priorities for advancing transportation investments to reduce carbon emissions from:

- On-road transportation sources, which include cars, trucks, buses and other vehicles used by people and for movement of goods on our transportation network.

- Development and maintenance of the transportation system, including infrastructure construction, repair and energy used in transportation facilities and operations.

Minnesota Electric Vehicle Infrastructure Plan

Minnesota will receive $68 million in federal funds from the National Electric Vehicle Infrastructure (NEVI) Formula Program over five years. This initially targets the deployment of DCFCs on the state’s Alternative Fuel Corridors (AFCs) which includes I-35 and I-94, every 50 miles and providing at least four 150kW chargers. The plan is focused on the light duty vehicle sector, but NEVI funded fast chargers could be used by MHD vehicles, especially those in lower weight vehicle classes. Larger vehicles, however, may have difficulty accessing the chargers if the sites hosting the chargers are not designed to accommodate larger vehicles.

Minnesota Clean Transportation Standard

The 2023 legislature established the Clean Transportation Standard Work Group to prepare recommendations for implementing a Clean Transportation Standard (CTS), including development of performance-based incentives to reduce carbon pollution from all transportation fuels including gasoline, diesel, biofuels and electricity.

The goal of a CTS is to significantly reduce transportation emissions, create new jobs, attract new investments and reduce air and water pollution in Minnesota. The work group will make recommendations on fuel pathways and determine impacts to jobs, fuel prices, rural and agricultural economic development and environmental justice for legislation in the 2024 legislative session to reduce the carbon intensity (CI) of all fuels used in transportation.

National Alternative Fuel Corridors

The Fixing America’s Surface Transportation Act of 2015 required the U.S. Department of Transportation (DOT) to designate national alternative fueling corridors (Title 23, United States Code, Section 151). The Bipartisan Infrastructure Law (BIL), enacted as the Infrastructure Investment and Jobs Act, amended Section 151 to update the requirements related to the designation of national alternative fueling corridors. The BIL, in Section §151(d), requires that DOT establish a recurring process to regularly update and redesignate the corridors. In accordance with 23 U.S.C. 151(a), corridor designations must identify near- and long-term needs for and location of, EV charging, hydrogen, propane and natural gas fueling infrastructure at strategic locations along major national highways.

Considerations in Reducing Vehicle Emissions

A ZEV powered by 100% sustainable fuels, would be the most appropriate vehicle to use from a GHG reduction perspective. This chapter of the report identifies several challenges and considerations in adopting cleaner vehicles, both ZEV and those vehicles using fuels with reduced carbon intensity. It recognizes that the cost of equipment, such as trucks and supporting fuel infrastructure and fuel, are a vital consideration in the transition to cleaner and greener forms of transportation, in a competitive market, where cost of transportation services is one of the most significant factors in decision making. Identifying these challenges is key to the development of climate change initiatives and strategies and realize those opportunities to make significant progress in addressing climate change associated with activities

Vehicle Duty Cycle

Successful deployments of low or zero emission MHD vehicles are when the vehicle duty cycle meshes with the capabilities of the technology. Distance traveled, elevation, driving conditions, payload and how long the vehicle is on the road and in the depot, will influence what routes can be transitioned to alternative fuel technologies and the type of charging or fueling infrastructure that is most applicable and cost effective.

Range

Range is a key consideration when comparing alternative fuel vehicles with traditional diesel. A Class 8 tractor trailer equipped with a 120-gallon tank could travel around 600 miles, while a truck equipped with two 150-gallon tanks could travel up to 1,500 miles. Alternative liquid fueled vehicle may have similar ranges to their diesel counterparts, but availability of the right type of fuel also influences distance and routes traveled. The median range of battery electric trucks available in the US marketplace is approximately 160 miles.

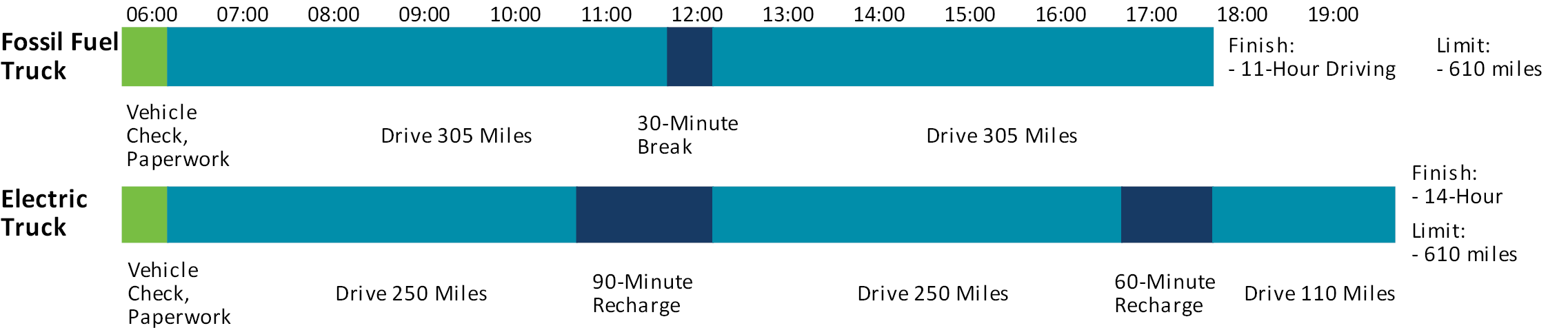

This range suggests most day trips, such as those associated with regional and local distribution of food and beverages, package deliveries, some waste collection rounds, some drayage trips from intermodal yards, some school bus and transit routes, would have routes that are suitable for battery electric trucks. Long-haul trucking with routes averaging 400-600 miles per day, would be challenging to adopt with today’s class 8 battery electric trucks, as most of them will require multiple charges in one day. This is illustrated in Figure 6-3 below which compares the operating timelines associated with a fossil fuel-powered truck and an electric truck with a range of 250 miles.

Figure 6-3: Example MHD Duty Cycles

These trips assume an average traveling speed of 55 miles per hour. After 250 miles, the electric truck driver would recharge, taking 90 minutes, followed by another 250 miles. Another recharge time of 60 minutes is followed by a final 110 miles of driving. After having travelled 610 miles, the electric truck driver must stop driving at 8pm because they are at the limit of both their 14-hour duty limit and 11-hour driving limit. The fossil fuel-powered truck, however, has also driven 610 miles and must stop due to the 11-hour driving limit. It is recognized this is a simplistic overview of a variety of factors, but it does demonstrate the impact of current Class 8 electric trucks on the long-distance trucking sector.

Even though longer range battery electric trucks (such as Tesla) have been introduced, the numbers are small. Furthermore, adding range to battery MHD vehicles requires heavier batteries, which despite the additional 2,000 pound weight allowance for battery and natural gas vehicles (bringing the overall gross vehicle weight for a class 8 truck to 82,000 pounds), would impact the revenue payload that can be transported. Further technological innovation is required to produce batteries capable of powering trucks over longer ranges but minimizing increase in battery weight; and for batteries to accept a very high charging rate to reduce charging time and for those chargers to be widely available.

Reducing the charging time is also a key factor for those trucks that require charging during a journey and to maximize the throughput of trucks that can be charged at a charging facility. To meet future needs, such as enroute charging, charging facilities will need to charge at speeds of greater than one megawatt. The Megawatt Charging System (MCS), capable of peak charging power of 3.75 megawatts (equivalent to an average power demand of 3,200 homes) was launched in 2022 and is designed to be a global standard, including the standardized location of the vehicle charging port on the left- hand side of the vehicle.

Fuel Availability and Certainty of Supply

MHD vehicle operators need certainty that their vehicles can be refueled or recharged, and the infrastructure is available to them when they need it. With diesel, that certainty is generally guaranteed due to the plentiful supply of the fuel, the established and robust distribution network supplying the fuel and the network of dispensing facilities. Alternative liquid fuel supply presents a different dynamic in that the facilities are not necessarily as widespread, or available as traditional diesel. Some alternative fuels can share the same infrastructure (pipes and storage tanks as traditional fuels) while others cannot. Fuel availability will influence the types of routes and distribution networks operators choose to implement cleaner vehicles on. For some fuels, such as B100 biodiesel, some elements of the fuel distribution infrastructure including production, exist with the state. According to the 2017 report, Economic Impact of the Minnesota Biodiesel Industry, 96% of Minnesota’s biodiesel consumption of 74 million gallons was produced within the state. For fleets domiciled in the state and whose routes are based on returning back to a depot after every shift, such as waste collection, MNDOT fleet and other government agencies who may have on site fuel storage and dispensing facilities, alternative fuels such as RNG and biodiesel may be more cost effective short and mid-term solutions to reduce emissions from fleet activity.

In terms of charging electric MHD vehicles and especially those engaged in timed deliveries and delivery rounds, the use of publicly accessible chargers does not give the certainty fleet operators require. Driver’s salary and benefits account for the largest costs associated with operating a truck and so keeping them productive is key to an efficient operation. Waiting in a queue and the time taken to recharge a vehicle, outside of a mandatory break, would not be cost effective and could jeopardize delivery windows and fulfilling the number of deliveries and collection in the delivery round. To have this guaranteed charging ability, fleet operators will therefore install charging infrastructure in their depots, garages or fleet bases and make use of the downtime associated with the vehicles that return to base every day and can be charged, typically overnight, until the next delivery round. One way around the certainty challenge is for EV charging providers to provide access to publicly accessible charging facilities on a reserved basis, using online booking/reservation systems. Another factor in this decision making is whether the fleet operator owns their fleet depot or garage. If the site is leased, the site owner would need to be involved and if the site doesn’t have a long lease, it may not be economically viable for the operator to invest in the infrastructure necessary for charging vehicles.

A significant proportion of the MHD fleet is made of vehicles in the lower weight classes of Class 2b and 3 and includes larger pickup trucks and vans. Operators of these vehicles may be independent contractors who do not have a fleet or depot base. They could install charging equipment at home, but this may be complicated if they live in a multi- occupancy building or where home-based charging is not possible. Publicly accessible chargers that will be used to charge autos can support these users. To support FCEV, hydrogen must be readily available and cost effective. Reducing production and distribution costs are key as is producing greater volumes of green hydrogen. According to the Alternative Fuels data Center, there are no publicly available hydrogen fueling facilities in Minnesota.

Cost of Zero Emission Vehicles and Charging Infrastructure

Zero emission vehicles are expensive when comparing initial capital costs with traditional fueled vehicles. A diesel-fueled school bus costs circa $100,000, but its battery equivalent with charging infrastructure is about $420,000 and heavy-duty BEVs can be between two to four times more expensive than their equivalent diesel counterparts. However, ZEVs typically have lower fuel and maintenance costs. Despite a closing gap in total cost of ownership (TCO) between MHD conventional fueled vehicles and ZEVs, the current higher capital cost of ZEVs represents a barrier to adoption associated with certain operations within the MHD sector. One challenge is access to finance.

Companies across the MHD spectrum, but especially smaller companies and owner operators, may be challenged to access funding at affordable rates or finding sufficient funding or down payments to invest in new, higher cost ZEVs. The lack of an extensive used after market for MHD ZEVs means that for companies who typically purchase used, but cheaper vehicles, that option is not readily available.

Charging infrastructure also requires financing andsome indicative costs are estimated below:

- Residential chargers may cost $500, plus installation.

- Level 2 commercial chargers may cost $20,000.

- Approximately $100,000 to install a 50kW DCFC (but costs are declining)

The user typically pays for the charging infrastructure and other construction as necessary to install the chargers such as cabling and conduits. If any electricity distribution system upgrades are required, the costs associated may also be passed to the electricity consumer. However, make ready programs, which can be used to support the financial costs of grid upgrades may be offered by the consumer’s electricity provider and Charging as a Service (CaaS) business models, where a third party procures, installs and operates the charging infrastructure and the fleet operator pays a fee to the CaaS operator, would help alleviate the upfront capital costs related to charging infrastructure. CaaS could be deployed as follows:

- A fleet operator has CaaS deployed in their depot/garage on an exclusive basis.

- A CaaS operator is installed in a depot, but unused capacity is used to supply other fleet operators.

- A CaaS supplier has their own facility and offers charging services to multiple operators.

Examples of commercial medium and heavy-duty charging business models include:

- Greenlanes: In April, 2023, Daimler Truck North America announced a $650 million joint venture with NextEra Energy and Blackrock Alternatives to develop and operate a network of charging facilities followed by hydrogen facilities on freight routes on the west and east coast and also in Texas, using existing infrastructure and amenities and adding greenfield sites.

- Volvo and Pilot Company: In November 2022, Pilot and Volvo Group plans to create a network of chargers for medium and heavy-duty trucks at select Pilot and Flying J truck stop locations across the country. There are 6 Pilot and Flying J facilities in Minnesota.

- WattEV: In May 2023, WattEV opened the largest public truck charging station in the nation, with 26 charging bays at the Port of Long Beach. It is also aiming to open three other charging facilities in California as well as other locations across the nation.

Another business model is Truck-as -a-Service (TaaS). This one stop shop service is where a driver or company pays a fee for the use of an electric truck, typically by the mile or by a route. The charge paid by the driver or company includes use of the vehicle, cost of charging and maintenance. A driver collects the vehicle, operates the truck and returns to the fleet location where the TaaS operator charges that truck ready for its next trip. The usage fee is typically higher than if the driver or company were to own and operate its vehicle and pay for charging infrastructure, but it would avoid high upfront vehicle and charger acquisition costs.

Electric Grid System, Utilities and Cost

The electric grid system generates, transmits and distributes electricity from where it is sourced to where it is consumed. New electricity loads, such as those associated with charging MHD vehicles requires planning and liaison with the supplying utility to ensure capacity within the electrical grid system is available. During the early phases of EV adoption, it is expected that the distribution part of the grid system (the infrastructure that connects transmission lines to the consumer’s facility) is likely to experience most requirements for upgrades.

Grid upgrades require time and are likely to be dependent upon existing utility workload and availability of components such as transformers. New rights of way may also be required and new components such as transformers may be required. Some or all of the upgrade costs maybe passed to the consumer. How much of this cost and in what format it could be reimbursed back to the utility, will depend upon each utility and its regulating authority. Some utilities have make-ready programs which assist consumers with the upfront costs of bringing additional power to their location.

However, fleets are unlikely to transition all their vehicles to electric at one time, the transition is expected to be gradual and in line with fleet renewal programs. A fleet could therefore add a number of electric vehicles to their fleet each year, potentially requiring incremental grid upgrades to facilitate the increased electrical loads.

Funding

While the total cost of ownership of alternative fueled vehicles may be closing with their fossil fuel counterparts, the upfront capital costs of vehicles, especially battery and FCEV trucks and associated charging and fueling infrastructure remains a barrier to widespread adoption. Some companies may be prepared to deploy these more expensive vehicles in their fleet to satisfy sustainability goals, while others cannot afford the additional expense. To help bridge the financial gap, grant funding can be used. However, it is recognized that many grant funding is limited and programs oversubscribed. Ensuring Minnesota can attract as much grant funding as possible will be a key factor in accelerating the transition to more sustainable fleet operations.

Potential Goals and Strategies

There are multiple ways to reduce GHG emissions associated with the MHD vehicle sector in Minnesota, including the increased use of lower carbon fuels and zero emission vehicles. This section outlines potential short- and long-term goals and strategies that could be pursued by MnDOT and other partners.

Short-term goals and strategies are intended to be implemented over the next four years, between 2024 and 2028 and focus on strategies that are more achievable in the given timeframe. Many of the recommendations focus on local and regional MHD operations. Long-term goals are intended for implementation between 2029 and 2025 and generally focus on strategies that require higher levels of funding and coordination with other partners and stakeholders. Where possible, the goals have also been developed to be in alignment with the 2022 SMTP goals and strategies. Specifically, many of the goals and strategies outlined in this plan address the Healthy Equitable Communities and Climate Action objectives noted in the SMTP.

Potential Considerations for 2024-2028

Issues and Trends

- Fuels such as biodiesel, renewable diesel, ethanol, natural gas, renewable natural gas and propane represent other pathways to reduced emissions, but do not achieve the same emission benefits as zero emission vehicles powered by renewable electrical energy and green hydrogen. Some of these fuels could be sourced and processed within Minnesota. The technology exists today and could have a role to play in reducing emissions from certain fleets based and operating within Minnesota e.g., municipal and government agency fleets and fleets solely operating and returning to a single depot location.

- Capital costs of heavier battery electric vehicles such as Class 7-8, are likely to remain more expensive than diesel, but the cost differential is likely to reduce over time.

- EPA Phase 3 emissions standards for model year 2027 are currently being proposed and are estimated to result in a reduction in emissions of CO2 by 1.8 billion metric tons from 2027 through 2055.

- Battery electrification in the MHD sector is likely to be focused in local and regional delivery and distribution fleets, where the total cost of ownership begins to align with fossil fueled vehicles. Long distance electrification is likely to remain challenging due to a combination of factors including vehicle range, slower charging speeds, vehicles costs and challenges in construction of charging facilities.

- Fuel cell trucks will be commercially produced, but supply of hydrogen to the transportation sector, at a comparative cost with diesel, is likely to remain challenging.

Goals

- Target the most polluting vehicles for removal from the statewide MHD inventory and replacing them with cleaner trucks.

- Secure as much funding for sustainable truck initiatives as possible.

- Facilitate and support the introduction of electrified vehicles in the regional and local distribution fleets based in the Twin Cities area, especially those located in and adjacent to areas of environmental justice and adverse air quality.

- Improve the environmental performance of Minnesota’s public sector fleet.

Strategies

Remove or Replace Older MHD Vehicles From Service

Accelerate the reduction in older vehicles (pre- 2010) in the Minnesota vehicle inventory by funding Diesel Retrofit/Replacement Programs. Potential mechanisms and supporting strategies include:

- Implement incentive, retrofit, or replacement programs. Schemes such as New York City’s Clean Truck Program, Houston’s Heavy-Duty Diesel replacement program and Minnesota’s Volkswagen settlement are in place. These schemes provide rebates for scrapping an older, program eligible vehicle and replacingit with a newer truck and cleaner technology. They include rebate incentive funding for all-electric, or EPA emission compliant alternative fueled (compressed natural gas, diesel-electric hybrid, plug-in diesel-electric hybrid) and diesel replacement trucks which varies from $12,000 to $185,000 in NYC. Houston’s program provides 50% of the incremental cost of diesel-powered equipment and 75% alternative fueled equipment such as LNG, CNG, electric etc.

- Programs should be reserved for replacing pre- 2010 vehicles only, to ensure the most polluting vehicles are removed from use.

- Programs could also be prioritized at fleets based in environmental justice areas, overburdened communities, communities of color and health sensitive communities, or operating predominantly in these communities. An enabling strategy would be to map existing freight corridors, freight related vehicle generators such as warehousing, distribution centers and intermodal rail yards and sensitive land uses to help inform decision making related to the prioritization of funding and where to target limited resources. Reducing the number of older, most polluting MHD vehicles based or operating in these communities should be a key priority.

- Programs should also require grant recipients who receive diesel vehicles to commit to other efficiency measures including anti-idling and driver training.

- Many grant programs are oversubscribed. Secure as much funding as possible and “stretching” the available funding, such as funding cheaper level 2 chargers, rather than more expensive fast chargers.

- Support early adoption of electric vehicles. The Agricultural Growth, Research and Innovation (AGRI) Biofuels Infrastructure Grant is an example, but this grant is focused on equipment to dispense biofuels to the public. A biofuels grant to support the acquisition and or conversion of existing vehicles using biodiesel, ethanol or RNG could support the introduction of these alternative fueled vehicles into Minnesota’s truck fleet.

Develop a Zero Emission and Cleaner MHD Vehicle Transition Plan For Public Fleets

One example is the Metro Transit Zero-Emission Bus Transition plan which required the Metropolitan Council to develop an electric vehicle transition plan and revise the plan every five years. A public fleet vehicle transition plan would identify the vehicle duty cycles that could be electrified or use other lower carbon intensity fuels for those vehicle duty cycles that are difficult to electrify, as well as considerations for provision of electrical capacity, charging infrastructure, availability and cost of vehicles and sourcing of alternative fuels. This could also include an inventory of pre-2010 trucks operated by state, local and other partner agencies and identify the replacement program for these vehicles. The plan would also consider how public sector contracts would include requirements for zero emission or cleaner fuels such as Minnesota produced biodiesel, to ensure public sector supply chains are reducing their GHG emissions.

Support a Charge as a Service Facility Operating by 2028 in the Twin Cities Metropolitan Area

To support the early adoption phase of electric vehicles in the MHD sector, a Charge as a Service (CaaS) facility should be developed nd operated within the Twin Cities Metro area located in, or in close proximity to, areas where fleets that are suitable for electrification (operating local and regional distribution routes returning to the same location at the end of the delivery round) are located, such as Eagan and Mid City Industrial. The CaaS facility provides charging for multiple fleet users and allows fleet operators who are trialing electric vehicles in their operations to avoid upfront capital costs and support fleets with a desire to use electric trucks who might have utility connection challenges until the challenges are resolved. The introduction of a CaaS operation will require public sector support and funding, as well as close coordination with utilities. MNDOT could issue a Request for Information (RFI) to assess the viability and market potential for a private CaaS operator in the Twin Cities region and then assess funding requirements and methods to select a private company that would develop and operate the facility.

Develop a Sustainable Truck Coordination/Working Group

Bringing various stakeholders such as utilities, other alternative fuel providers, truck dealerships and fleet operators, Minnesota government departments such as the Minnesota Pollution Control Agency together can help direct funding, identify barriers and solutions, share successes and case studies and support the transition to more sustainable truck operations. This group could be modelled on the Minnesota Freight Advisory Committee (MFAC) or be part of the MFAC with a Sustainable Truck Sub- committee. This group would also have the potential to be proactive and identify recipients for grant funding and assist with the grant funding application.

Support Improved Data Collection

Work with departments such as DPS to develop methods to analyze state databases to assess the age, vehicle class (FHWA or National Highway Traffic Safety Administration (NHTSA) classification), engine/fuel type of trucks registered and operated in the state, including ZEV.

Coordinate with Utility Companies

Utility companies are a key component in facilitating the transition to electric trucks. Recognizing that this transition will present challenges to both utilities and fleet operators there are a number of actions that could be adopted to help streamline the adoption process, reduce costs and time for deploying charging private, depot-based charging infrastructure. These include:

- Establishing a point of contact within utilities for MHD fleets

- Develop guidance documents to help MHD operators understand and navigate the various processes to plan, design, install and operate charging infrastructure.

- Develop EV-specific rate designs, including time of use programs.

- Access to charging infrastructure make ready programs.

- Proactively engaging with MHD fleets to assess and uptake of MHD vehicles and to help prepare the grid for increasing fleet electrification.