Update

Impact of 2017 and 2018 Legislative Sessions on the 2018-2037 MnSHIP

Overview

Since the 20-year Minnesota State Highway Investment Plan was last updated in 2017, the Minnesota Legislature provided additional funding for state highway construction projects. In the 2017 Legislative Session, MnDOT received $804 million for state road construction from additional Trunk Highway bonding authority and a transfer from the State’s General Fund to the Highway Use Tax Distribution Fund, from which MnDOT receives a portion for state road construction.

The Legislature also authorized Trunk Highway bonding and funds for the Corridors of Commerce program in both the 2017 and 2018 sessions.

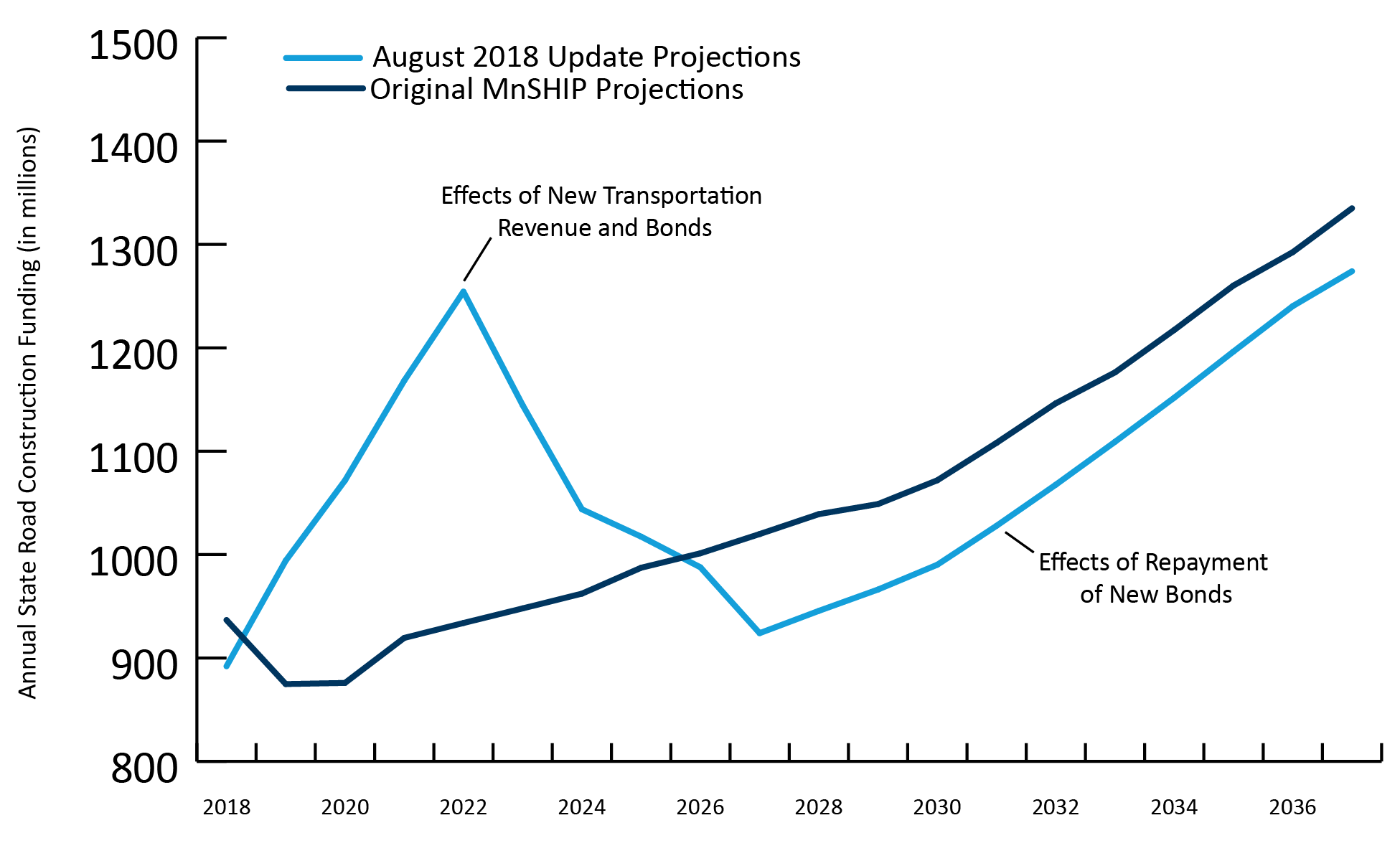

MnDOT has revised the 20-year state highway funding projection in MnSHIP to account for this additional funding. In the near term, this new funding allows MnDOT to add additional construction projects and increase the scope of already programmed projects. Over the long term, however, repayment of the bonds will reduce the previously projected available trunk highway funds in future years.

This document provides an overview on the overall impact on the MnSHIP investment direction and implementation.

Additional Transportation Funding from 2017 and 2018 Legislative Sessions

In 2017, the Minnesota Legislature provided additional funding to MnDOT by statutorily transferring some existing transportation related revenues to the Highway Users Tax Distribution Fund, including sales tax on auto parts, motor vehicle rental and sales tax, and motor vehicle lease sales tax. This transfer was written into statute and is now part of the base funding for highways in Minnesota. MnDOT assumes this will continue into the future. The Legislature also provided authorization for additional Trunk Highway bond sales. In total, MnDOT received $164 million in Trunk Highway funds from the transfer of existing revenue sources and an additional $640 million through bond sales.

During the 2017 and 2018 legislative sessions, MnDOT also received a total of $850 million for the Corridors of Commerce program from Trunk Highway funds and bonding. The Corridor of Commerce program was created by the Minnesota Legislature in 2013 to provide additional highway capacity on segments where there are currently bottlenecks in the system, improve the movement of freight, and reduce barriers to commerce.

In August 2018, MnDOT revised the 20-year funding projection in MnSHIP to account for these Legislative changes. Figures 1 and 2 outline the differences from the original MnSHIP funding projections and the adjusted funding projections updated in 2018.

Figure 3 shows the bond repayment schedule from the original MnSHIP funding projections and the updated projections. Starting in 2024, an additional $80-$110 million per year is needed for debt service.

Figure 1: Comparison of Original Funding Projections and August 2018 Updated Projections

Figure 2: Summary of Original Funding Projections and August 2018 Updated Projections

| Years | Original MnSHIP Projections | August 2018 Updated Projections | Difference |

|---|---|---|---|

| 2018-2027 | $9.46 billion | $10.50 billion | $1.04 billion |

| 2028-2037 | $11.70 billion | $10.97 billion | -$0.73 billion |

| 20 Year Total | $21.16 billion | $21.47 billion | $0.34 billion |

Figure 3: Summary of Change in MnDOT 20 Year Bond Repayment

| Original MnSHIP 20 year Bond Repayment Total | August 2018 Update 20 year Bond Repayment Total | Change in Total 20 year Bond Repayment |

|---|---|---|

| $3.00 billion | $4.44 billion | $1.44 billion |

Investment Priorities for New Revenue

This additional funding was passed after the adoption of the 2018-2037 Minnesota State Highway Investment Plan in January 2017. Therefore, it was not reflected in the plan’s final investment direction.

During the MnSHIP public outreach process, MnDOT asked stakeholders and the public what their priorities would be should MnDOT receive additional funding. The adopted MnSHIP included specific priorities for any new funding. First, MnDOT would prioritize maintaining and repairing existing assets (pavement and bridge condition) on the state highway system. The next priorities were strategically improving mobility and reliability on the National Highway System and investing in additional Main Street projects.

Based on the priorities for additional revenue in MnSHIP, MnDOT’s investment strategies for this new funding were as follows:

- Long-term pavement rehabilitation and reconstruction projects to improve pavement condition and remaining service life, including upgrading short-term pavement preservation projects into long-term improvements

- Additional bridge repairs and replacements

- Initial investments in major urban corridor projects like I-94 from St. Paul to Minneapolis and Twin Ports Interchange in Duluth

- Areas identified by MnDOT Districts as underfunded risks within the existing program, including main street reconstruction projects, drainage infrastructure improvements and multi-use shoulders

Increased Mobility Spending in the Twin Cities

As part of implementing those investment strategies, many existing pavement projects were upgraded to long lasting pavement fixes. Pavement outcomes at the end of the 10-year Capital Highway Investment Plan show measurable improvement compared to previous projections. Given the improvement in projected pavement performance, MnDOT decided to shift $50 million per year of pavement investment on the National Highway System towards investment in Twin Cities Mobility in fiscal years 2024, 2025 and 2026. In the 2018-2037 MnSHIP, Twin Cities Mobility investment was scheduled to end in 2023 as the investment direction shifted to a primary focus of maintaining the existing system.

In addition to the shift from National Highway System pavement investment, MnDOT is directing a portion of the new funding to continue investing in Twin Cities Mobility through the full 20 years of the plan. The estimated amount of additional investment in Twin Cities Mobility is projected to fluctuate between $20-30 million per year.

Corridors of Commerce

Also in 2017, the Legislature provided additional funding to the Corridors of Commerce program, which has a legislatively established project selection process separate from the MnSHIP investment direction. For the Corridors of Commerce funding authorized by the Legislature in 2017, MnDOT held a public recommendation period for projects in early 2018 and selected four projects. In late May, MnDOT selected an additional three projects with additional funding authorized by the Legislature during the 2018 legislative session.

The Corridors of Commerce investments are primarily capacity expansion projects (e.g. adding new lanes). Although these projects are still being scoped, they will likely increase the amount of investment in Twin Cities Mobility, Greater Minnesota Mobility, and Regional and Community Improvement Priorities once they are added to the STIP. In some cases, the Corridors of Commerce projects provide opportunities to make additional needed investments in pavement and bridge condition and repair or replace other roadside infrastructure. MnDOT is currently evaluating opportunities to coordinate additional repairs with the Corridors of Commerce projects for efficiency of project delivery and to avoid future detours and disruptions to adjacent communities.

Impact on Investment Direction

Because of the decisions discussed above, there are several impacts to 2018-2037 MnSHIP investment direction. Figure 4 shows the updated investment direction for the twenty years of the plan. The largest change occurs in the Twin Cities Mobility investment category, which increased by approximately $600 million.

Several other categories including Pavement Condition, Bridge Condition, Traveler Safety, and Roadside Infrastructure also received a short term increase. Pavement Condition for example shows an increase of $249 million in the next ten years. However, looking out 20 years, Pavement Condition investment actually shows a decrease of $220 million in investment compared to the original MnSHIP investment direction. This is due to a projected decrease in total state highway funding in the second ten years of investment as the bonds for the 2017 additional Legislative funding and the Corridors of Commerce program are repaid (see Figures 1, 2 and 3). Investments in Pavement Condition make up the majority of MnDOT investment in the state highway system. As such, it has the largest reduction in the second ten years as projected funding decreases. Similar to Pavement Condition, investment in Bridge Condition also decreases in the second ten years as bonds are repaid.

Other categories also decrease in the revised MnSHIP projection. The primary way MnDOT invests in bicycle and pedestrian infrastructure is as part of pavement projects. As investment in Pavement Condition decreases, Bicycle Infrastructure and Accessible Pedestrian Infrastructure also decreases in the revised investment direction.

Freight investment also sees a reduction. The Freight investment category is funded by the National Highway Freight Program. When MnSHIP was adopted in January 2017, projects had not yet been selected for that program. In October 2017, MnDOT selected projects for years 2019-2022, including projects that are located off of the state highway system and therefore not covered by MnSHIP. The level of investment was reduced in the Freight category to match this change.

Figure 4: Comparison of Original and Revised 20 year MnSHIP Investment Directions

| Investment Categories | Original 20-Year MnSHIP Investment Direction | Percent | Expected MnSHIP Investment Direction Based on Legislative Impacts | Percent | Difference in Dollars | Difference in Percentage |

| Pavement Condition | $10.31 B | 49.4% | $10.09 B | 48.3% | -$220 M | -1.1% |

| Bridge Condition | $2.38 B | 11.4% | $2.30 B | 11.0% | -$80 M | -0.4% |

| Roadside Infrastructure | $1.60 B | 7.7% | $1.71 B | 8.2% | $110 M | 0.5% |

| Jurisdictional Transfer | $90 M | 0.4% | $90 M | 0.4% | $0 M | 0.0% |

| Facilities | $80 M | 0.4% | $85 M | 0.4% | $5 M | 0.0% |

| Traveler Safety | $680 M | 3.2% | $740 M | 3.5% | $60 M | 0.3% |

| Twin Cities Mobility | $230 M | 1.1% | $830 M | 4.0% | $600 M | 2.8% |

| Greater Minnesota Mobility | $25 M | 0.1% | $25 M | 0.1% | $0 M | 0.0% |

| Freight | $610 M | 2.9% | $580 M | 2.8% | -$30 M | -0.2% |

| Bicycle Infrastructure | $130 M | 0.6% | $120 M | 0.6% | -$10 M | -0.1% |

| Accessible Pedestrian Infrastructure | $530 M | 2.5% | $500 M | 2.4% | -$30 M | -0.2% |

| Regional and Community Improvement Priorities | $310 M | 1.5% | $330 M | 1.6% | $20 M | 0.1% |

| Project Delivery | $3.27 B | 15.6% | $3.06 B | 14.7% | -$210 M | -1.0% |

| Small Programs | $620 M | 3.0% | $430 M | 2.1% | -$190 M | -0.9% |

| Total | $21 B | 100.0% | $21 B | 100.0% | $25 M | 0.0% |

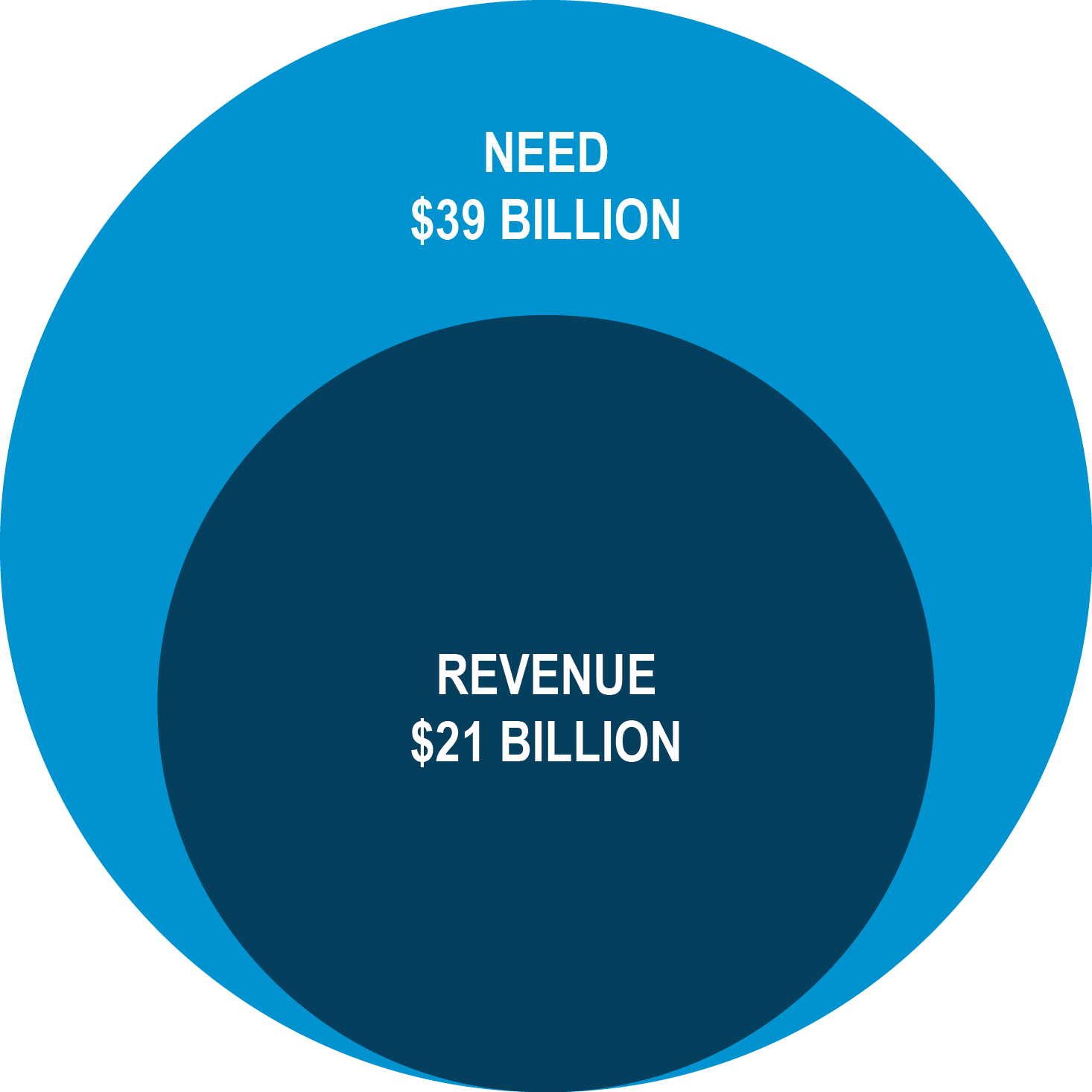

Impact on Investment Need

In MnSHIP, MnDOT identified approximately $39 billion in needs for the Minnesota state highway system over 20 years (see Chapter 3). If fully funded, this level of investment would ensure that the state highway system meets all federal and state performance requirements and makes substantial progress toward realizing the Minnesota GO Vision. It would also allow MnDOT to effectively manage its greatest risks in each investment category. However, MnDOT estimated it will have $21 billion to invest in the state highway system over the same time period, resulting in an $18 billion funding gap.

The largest areas of unmet need identified in the 2018-2037 MnSHIP include investments in:

- Pavement and Bridge Condition ($3.40 billion in unmet need)

- Mobility in the Twin Cities ($4.34 billion in unmet need)

- Regional and Community Improvements Priorities ($2.31 billion in unmet need).

The additional trunk highway revenue and Corridors of Commerce bonding allowed the state to address previously unmet needs. Combined investment in mobility and regional and community improvement priorities reduced the projected need by $950 million for these categories.

Investments through trunk highway bonding provided around $600 million to advance and add pavement and bridge projects. MnDOT is currently working on projecting the impact these projects had on the overall pavement and bridge investment need. MnDOT anticipates this process to be completed by the spring of 2019. Additional long term investment is needed to continue to address pavement and bridge condition, mobility in the Twin Cities and regional and community improvements beyond the next four years.

The additional revenue clearly provided benefits. However, the repayment of both trunk highway and Corridors of Commerce bonds increase MnDOT’s debt service at the expense of the regular program, particularly in the second ten years of the plan.

Figure 5: Comparison of Investment Need and Available Revenue from MnSHIP adopted in 2017

For More Information

For more information about MnSHIP and how MnDOT invests in the state highway system, view the plans: